Centenary University

Your journey is just the beginning. We see you, we support you, and we inspire you to shape the future you want.

We CU—where who you are today meets the success of tomorrow.

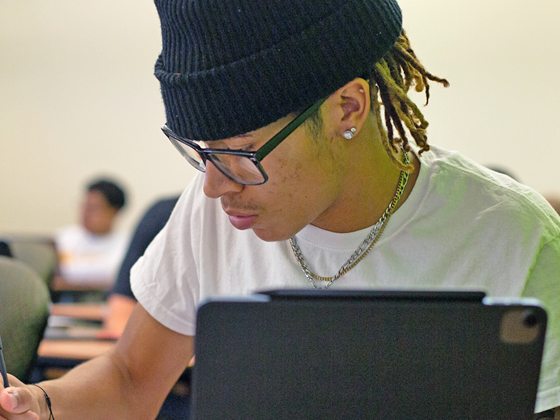

We CU Learning & Growing

Our programs adapt to meet you where you are and fit the way you learn. Centenary's campus and classrooms provide a secure and caring environment for an educational experience that responds to your needs.

Explore Career-Building Degrees

Centenary University is a private institution in New Jersey committed to life-long learning. Our degrees are designed to evolve with you—equipping you with the skills and knowledge to succeed today and adapt to tomorrow's challenges, at every stage of your career.

Discover Unique & Innovative Programming

We CU Applying to Centenary University

We partner with you every step of the way— to find the right program and help make it affordable.

Invest in Your Future

Apply for FAFSA and explore scholarships, grants, veteran and G.I. benefits, EOP or NJ Stars. Our dedicated team is here to help bring education within reach.

- 12:1 Student-to-Faculty Ratio

- 60+ Academic Programs

- 72 hours To an Acceptance Decision

Over 150 Years of Student Success

At Centenary University, we take pride in providing innovative educational experiences where every student’s journey is unique. We are committed to supporting your growth—academically, personally, and professionally.

Core Success Skills for Life

Our students graduate equipped with key success skills, including Emotional Resilience, Intellectual Curiosity, and Intercultural Competence—ensuring they reach their full potential.

Leading with Confidence

Centenary graduates are prepared to lead with confidence, adapt to an ever-changing world, and make a lasting impact in both their careers and communities.

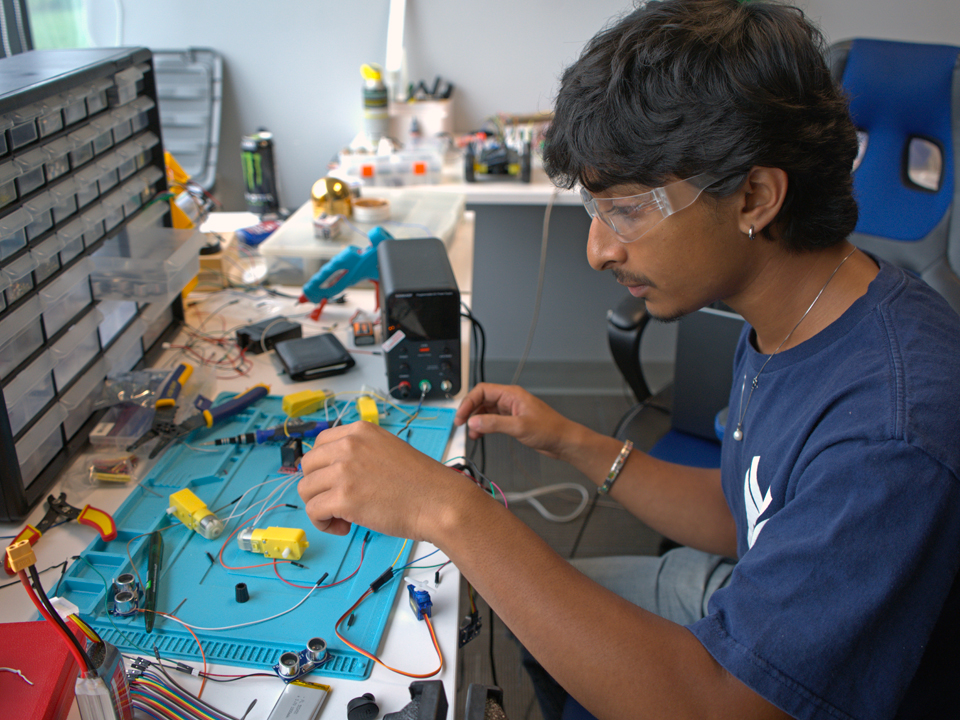

Earn a Living While Earning a Degree

Earn-as-you-learn degree programs, in partnership with The Ideal Institute of Technology, allow you to pursue your bachelor’s degree while earning money and gaining valuable experience in your field of study.

It All Starts Here

Unique Equine Studies Programs

Centenary’s Equine Studies programs, offer a range of rewarding career opportunities in a field that’s as dynamic as it is diverse.

Our programs provide a solid academic foundation, combined with hands-on experience in the care and management of horses. Through internships at breeding and training stables, veterinary clinics, therapeutic riding programs, equine publications, pharmaceutical companies, marketing firms, and more, you'll gain the real-world skills necessary to excel.

Beyond the Classroom: Compete at the Highest Level

Take your skills to the next level by competing on Centenary’s nationally recognized riding teams:

- IDA – Intercollegiate Dressage Association

- IHSA – Intercollegiate Horse Show Association

- Hunter/Jumper Team